I have lived and worked in numerous American cities and other countries, gaining firsthand insights into various cultural and social norms. As an expatriate in Muslim-majority countries in Southeast Asia and the Near East, I learned to read the fine print of each culture. My work included translating Turkish culture on live television for five million Americans and publishing a stereotype-busting book about Turkey. These international experiences enhanced my adaptability and cultural competence, allowing me to navigate diverse environments effectively. They also reinforced my understanding of global interconnectedness and the importance of cultural diplomacy.

The Future of Work 2023

We’re not “post pandemic” just because we want to be.

(And yes, it’s the same sad story from last January, and the year before. I have been early and sadly accurate on this pandemic.)

So - 3 years in- in our life-work environments how do we deal with this new hybrid state — this state of limbo — of being weary of the public health safety protocols and wary of the consequences at the same time?

“As we look at 2023, how do we deal with our new hybrid state: weary of pandemic protocols, wary of the consequences?”

As the new year starts, how do we, all of us, everyone really, but in this case businesses, and in particular company boards and the board directors deal with our not-even-new reality, and our insistent future?

“Would you rather have a hybrid or virtual meeting that is quorate and high attendance, or would you rather risk apologies from directors unable to attend meetings face to face if they are forced to commute?” asks my longtime board journey mentor Shefaly Yogendra in her year end wrap up.

Read it here: Boards and governance: Lessons from 2022

Meanwhile, a future of work inspiration of mine, Budd Caddell who credits Kevin Kelly for the term ‘Protopian Organization’ and offers this one prediction for 2023 from the wreckage of 2022: there is a vacuum for a new kind of organization that takes the future seriously, and creates real change with its people and communities.

With trust in institutions waning, employees disengaged, consumers looking for meaning, progress stalled both at the org- and systemic-level”, a new, more mature organization can emerge, Caddell says.

I immediately recognize this is an opportunity for businesses that take living with the pandemic seriously - to offer the people they work with a baseline of health and safety - by upgrading their ventilation systems, and allowing hybrid work and virtual meetings as Yogendra mentions above, but I see companies failing to do this more often than not. Even companies that pride themselves on futurism, like Google.

“It’s time for organizations that take the future seriously and work for mutual enrichment of their people and communities”

These new protopian organizations he describes, “they don't just paint an optimistic picture of tomorrow, they respect the problems that come with trying to make anything better. These orgs won't just slap "we make the world a better place" on their label and career site and ignore the unintended consequences of their business model and culture.”

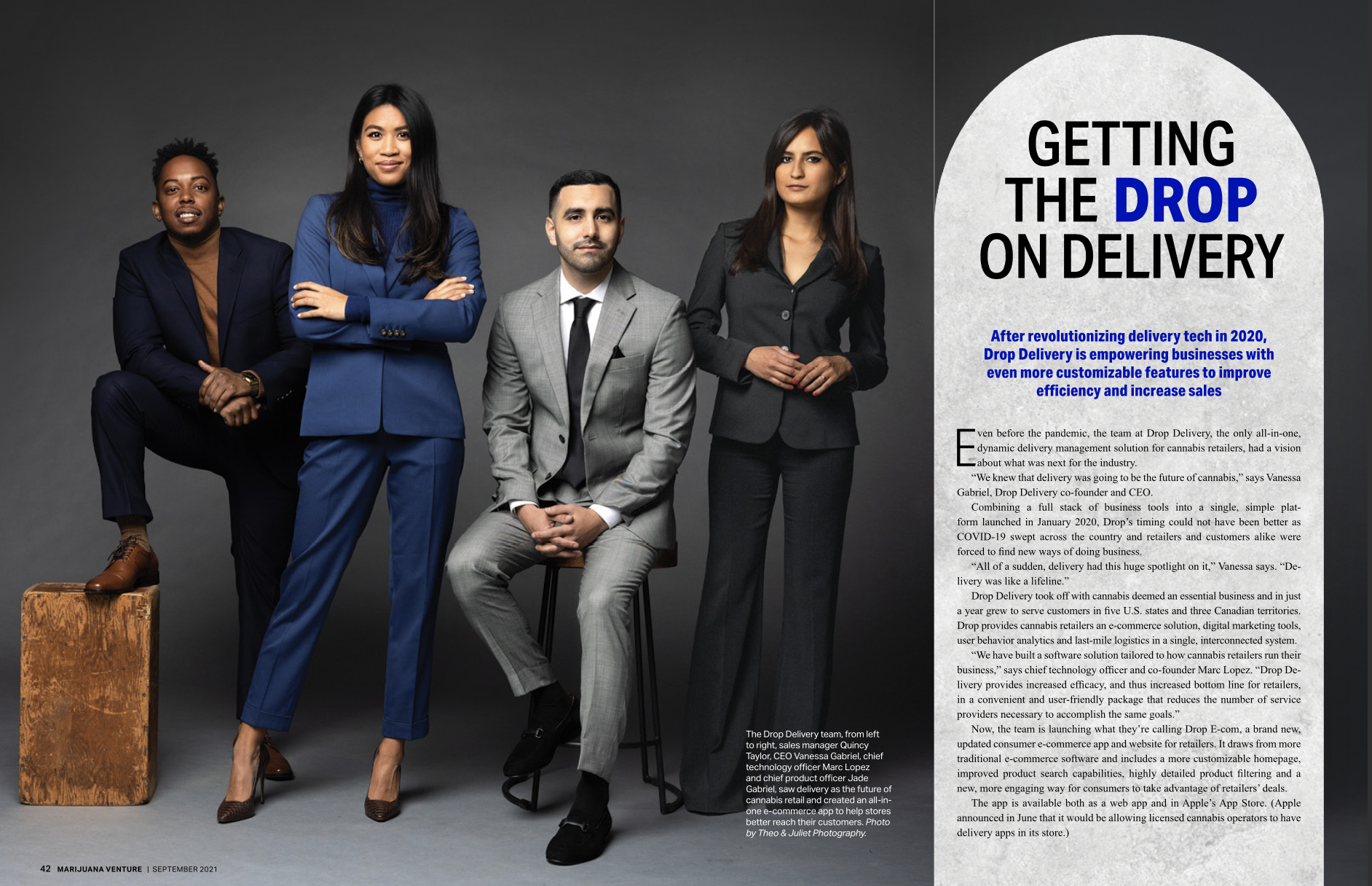

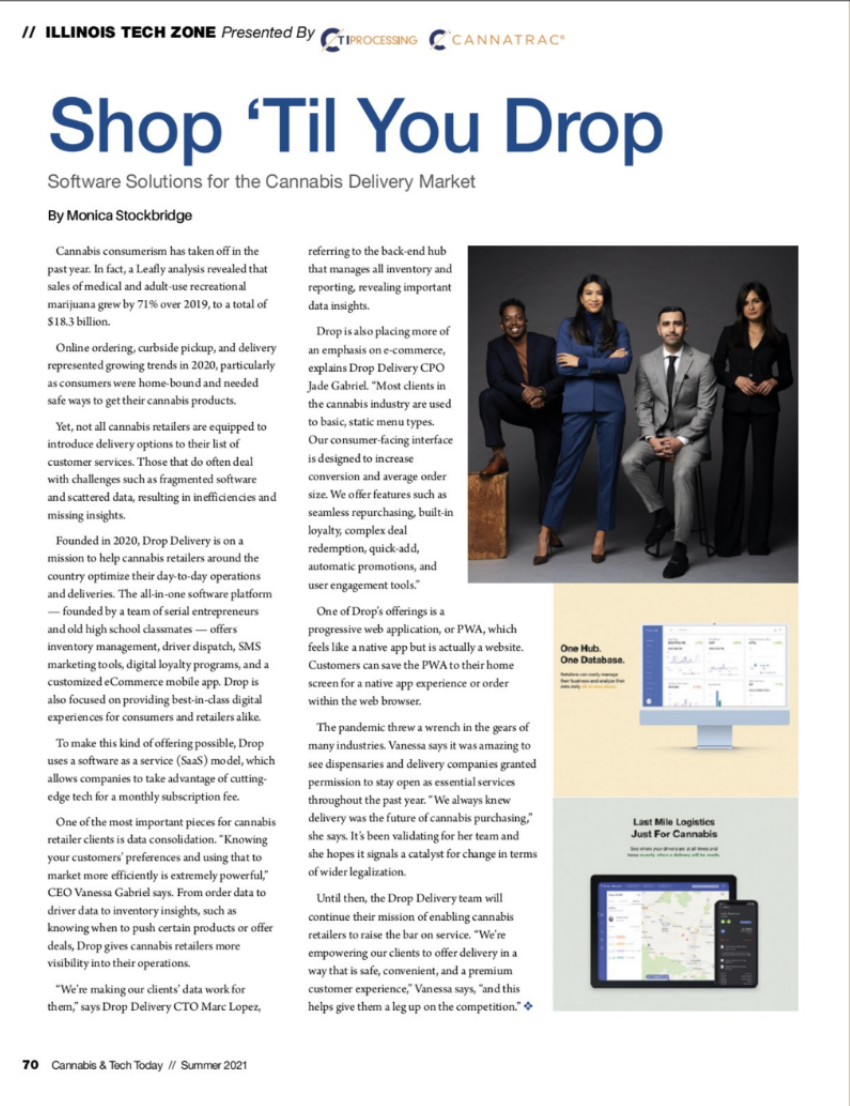

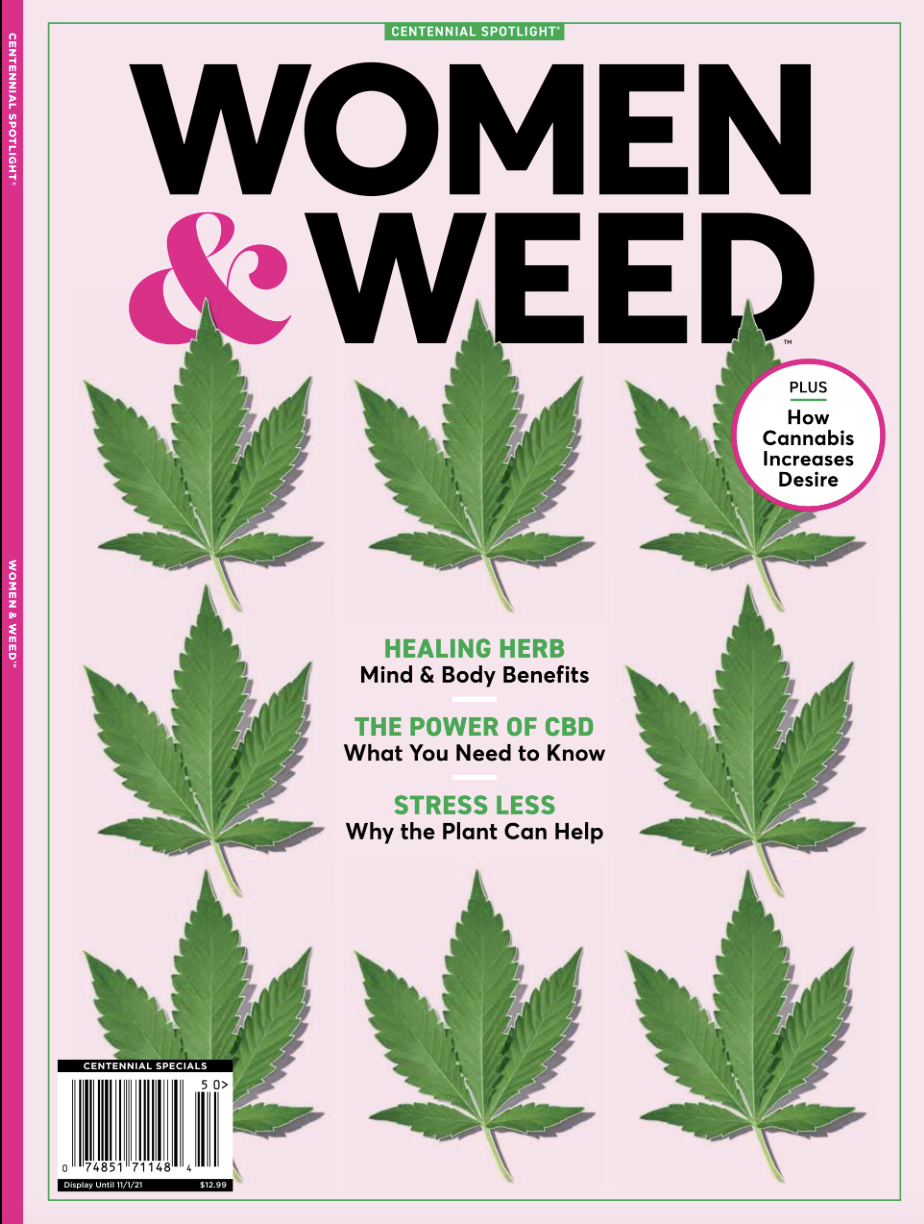

The September Issue: Drop is "the future of delivery"

“What does it look like when a pre-Series A startup is on newsstands in three national industry magazines at the same time? ”

Congrats to the young diverse team at Drop Delivery which Marijuana Venture calls in its cover story "The future of delivery".

Marijuana Venture writes: “After revolutionizing delivery tech in 2020, Drop Delivery is empowering businesses with even more customizable features to improve efficiency and increase sales.”

Women & Weed calls CEO Vanessa Gabriel “the delivery diva”.

Cannabis & Tech Today says Drop’s on a mission to help retailers optimize their day-to-day operations and delivery services with cutting-edge technology for a monthly subscription fee. That’s the SaaS model.

Why am I writing about Drop?

If you missed it, I’ve been pleased to be bringing my experience to Drop as their chief operating officer since last November!

The tech + cannabis industry space is having a particular moment, as legalization spreads to more states and during the pandemic “cannabis has become an essential household item.” California, which began adult-use sales in 2018, saw consumers rise to 45% of all adults in the first half of 2021 according to BDSA’s business intelligence and market share tracking. Consumption is on the rise across the nation.

“Cannabis has become an essential household item. Consumerism has exploded. Delivery is the future.”

…and the news does not stop.

Yesterday, Drop won the Poseidon Asset Management Green Shoots Pitch Forum, a special event that connects top-performing cannabis companies across all verticals (licensed and ancillary), with accredited investors. It’s organized by Poseidon, a first mover in the cannabis investment space named Top Hedge Fund Q3 2020 by Barclay Hedge. Winning sends Vanessa to pitch to investors on stage during MJUnpacked in Las Vegas in October, an industry conference for brands, retail executives, and investors.

Unmentionable wins! Actually, it was a tie: Judging the finals at another exciting venture bootcamp at UC Berkeley

“And the winner is...hard to describe in front of a bunch of people I just met.”

Had a fun morning meeting all the bright-eyed and bushy-tailed brilliant students, program coordinators like Justin Wong and Simran Kaur and Anika R. and other venture judges and Silicon Valley investors like Alexander Walterspeil (head trader at Indaba Capital Management), Brandon Drew (General Partner at SaaS Growth Ventures), and Bob Upham of Tess Ventures to hear the pitches for Gigi Wang’s Berkeley Method of Entrepreneurship Bootcamp Final Presentations.

I’ve been mentoring and judging Bootcamps at Sutardja Center for Entrepreneurship and Technology for about five years since I met Gigi at the European Innovation Academy in France. Every Bootcamp is different but they’re all a whirlwind of inspiration and learning, and a shot in the arm of what my fellow startup mentor Pamela Day calls “Vitamin S”, for Students.

This year in my track we heard four startup ideas developed during the week’s Bootcamp accelerated process. I was joined by two venture capitalists: Bill Reichert, Partner at Pegasus Tech Ventures; and Shuonan Chen, general partner at Innovation Overflow Venture Capital.

“We chose two pitches, it was a tie! ”

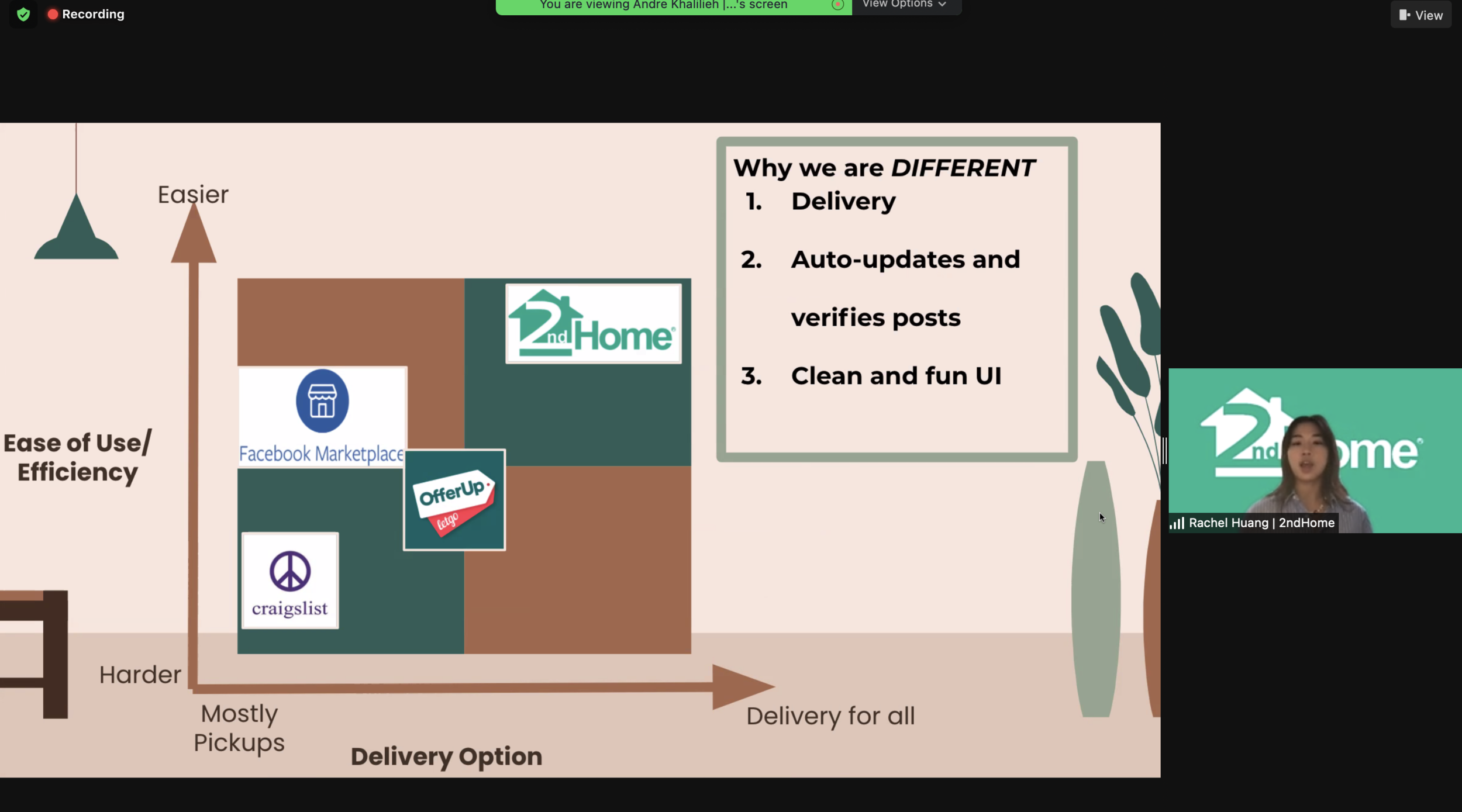

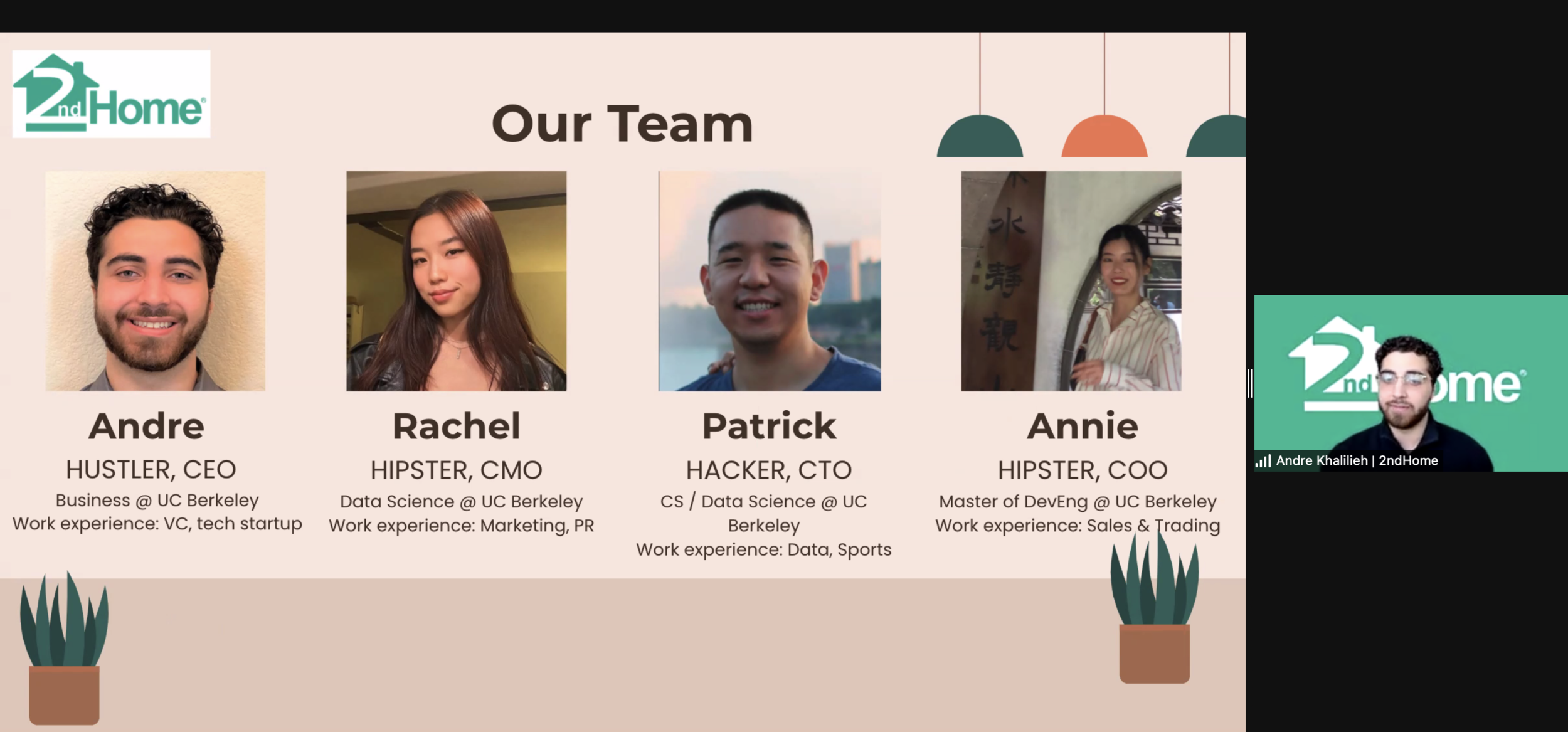

“One winning team, described as 50% ‘hipster’, proposed a second-hand furniture service for student communities.”

The tie was between a second-hand furniture service from a team that self-described as 50% hipster and delivered an all-bases covered pitch including customer validation and operating expenses on their financial projections; and a company that I found intriguing, but not easily mentionable during my one-day appearance at Bootcamp.

Most years when I can, I enjoy mentoring the teams during the week leading up to the final, giving me a chance to get to know the entrepreneurs and advise their team formation and development of their venture pitch.

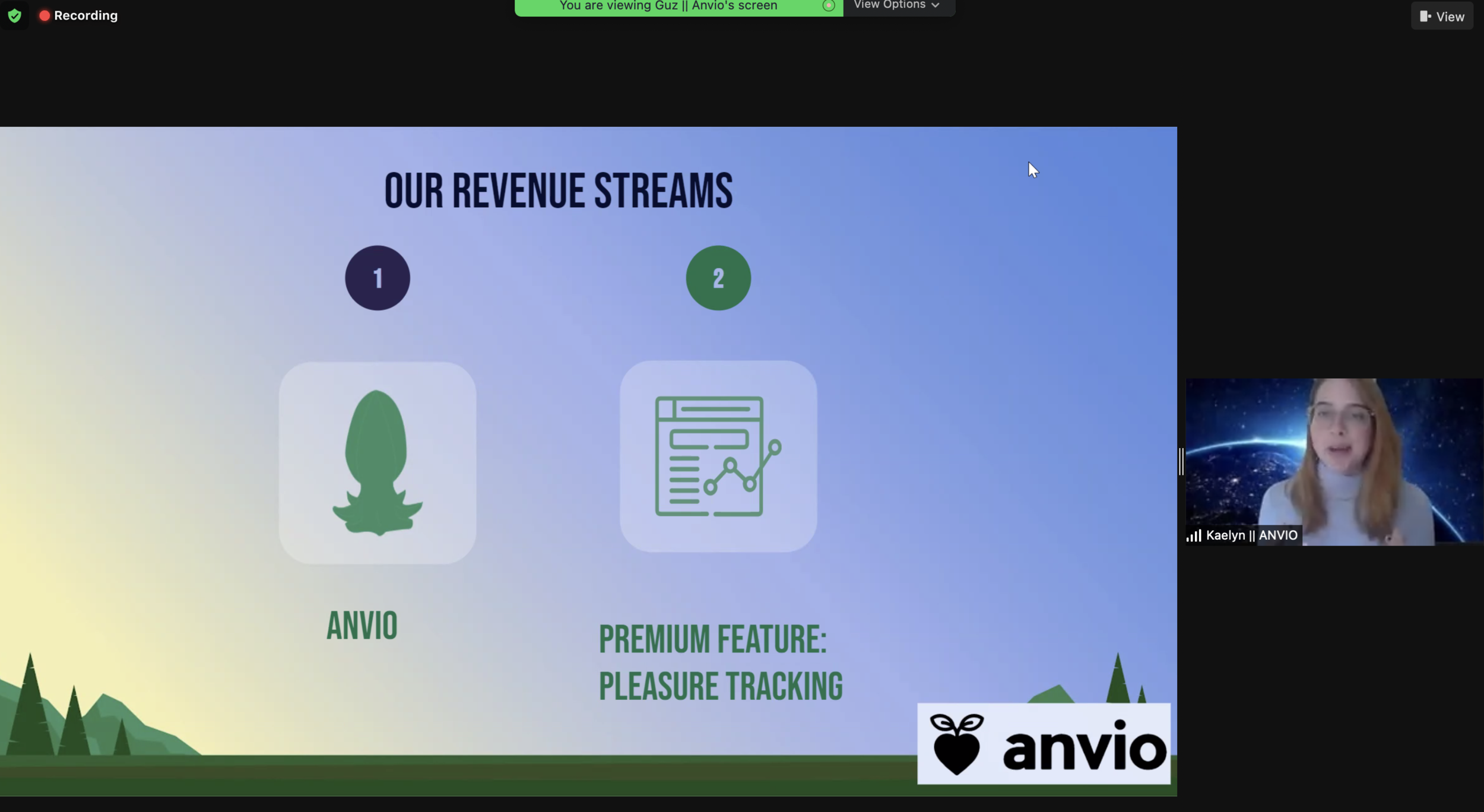

I didn’t have that chance this year, otherwise I certainly would have had more time to construct how I might present Anvio as winners, live on the Zoom to all participants. Somehow I still did that within minutes of hearing of them (waiting for the video of the event to recall exactly what I said without using the term the team suggested: “sex toy”, this is FAR MORE than a toy). And now I’m struggling to describe it here, on the Internet where nothing ever dies.

I’m not sure I want to rank for these terms in perpetuity….

“I don’t want to rank for these terms yet I see the need for this intimate smart device and subscription service …there’s definitely something there with this sexual wellness training tool. ”

…there’s definitely something there with this sexual wellness training tool.

There’s something there in its not-often-enough-spoken-of problem, its ‘non-gendered’ solution, a knowledge and support community, a data-driven wellness option, an intriguing new smart device, a relationship aid, a subscription service for a monthly box of related products, and still there is so much left unsaid.

You’ll have to look for it in the slides above!

As Shuo Chen suggested during the judging, the Anvio team can always start with a MVP (minimum viable product) of a box subscription and discussion community as they continue to research and develop the intimate electronic device itself, and design and build the mobile app that supports it.

This particular problem space may be hard-to-talk-about (sort of, Teen Vogue famously covered it in 2017, and incited a backlash for erasing women — calling them “non-prostate owners”) yet the problem is a known source of trauma for millions of newcomer practitioners.

“Ok, ok. Enough prevarication.

You might call the Berkeley Bootcamp winner I championed...

’A SMART BUTT PLUG’.

Yep, went there! 😱”

Phew, I said it and I’m still alive. (Now to watch my website ranking skew over time…)

Let’s put it this way. This winning formula is…

Anvio = a not-often-spoken-about problem + a non-gendered solution + a knowledge/support community + a data-driven wellness option + an intriguing new smart device + a relationship aid + a mobile app supporting a subscription service for data + a box subscription service for related products.

Congrats again to all the hard-working BMOE teams for a great Final Presentations Day. I look forward to what you do next!

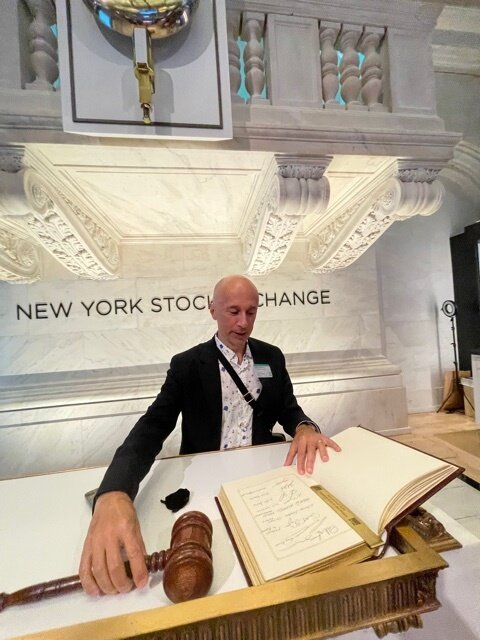

Ringing the bell at the New York Stock Exchange with a unicorn company!

I was walking down Wall Street last week. It was 90 degrees and muggy, a moment of after-lunch calm. As I passed the historic, columned stock exchange I over heard a New York Tour Guide talking to a group of tourists.

Pointing to the facade announcing Owlet Baby Care’s IPO, she said: A baby went public today.

“A baby went public today.”

Not quite, but funny!! The connected nursery startup Owlet is 7 years old and now it’s a publicly listed newcomer on ‘the granddaddy of stock markets’.

I called out into the quiet street, ‘‘They make smart socks that measure blood oxygen and other vitals to alert you if your baby is in trouble.”

“Good to know,” a man in the tour group called back.

Seriously, this happened.

A spunky JLo could play me in the romantic comedy where a scene like this would be more likely to take place.

It is good to know.

Owlet says they’ve monitored the health of 1 million babies.

When Burc joined them in 2020, we discovered that unlike other startups both of us had worked with in San Francisco, Los Angeles, New York, and Istanbul, almost everyone we mentioned it to knew this Silicon Slopes Internet-of-Things (IOT) product. They had either used it with their own infants — some were on their third device — or had just gotten one for a coming birth, or had given one to a friend with a budding new family.

I waved and kept on walking. I was going to meet my husband and the president of Owlet around the corner before we were due to gather inside ‘the center of global financial markets’, the NYSE, for the closing bell ceremonies that mark the end of the day’s trading.

Photobombed by a Faberge urn

That urn over Burc’s shoulder — it was always in focus, he was blurry — was “produced by House of Faberge, gifted to the exchange by Czar Nicholas II of Russia in 1904 for listing a $1 billion bond issue”.

After passing stock exchange museum pieces at the entrance but not getting to look at them, like the original Thomas Edison stock ticker machines I noticed just at the elevator, we assembled in the classical revival Board Room that hosts world leaders, celebrities and business icons before heading down to the trading floor. There were cookies.

There was a short program about becoming listed on the exchange, a ceremony with a commemorative coin presentation by a stock exchange executive who joined the team on the balcony downstairs, and a speech by the CEO Kurt.

Congrats to my husband Burc Sahinoglu & everyone at Owlet Baby Care for going public as a unicorn (translation: that’s “a company with a $1+ billion valuation”) and for ringing the closing bell at NYSE last week!

It was a stellar New York summer day, finished by a cruise around the island getting to know Owlet founders, executives, family, board members, and investors, enjoying the sunset breezes over enduring landmarks and stunning new developments.

I’ve said it before and I’ll say it again, I love New York!

Welcoming a babytech unicorn to the family

Mine is a household of entrepreneurs. My husband Burc and I have both been working in the tech venture and startup world for decades. We’ve done startups together too!

Today the Silicon Slopes Series-B IOT company he joined last year — Owlet Baby Care, which makes a smart sock to measure blood oxygen levels in infants, among other connected nursery products — announced their merger with a special acquisition corporation at a Wall Street valuation of more than $1 billion. That’s a unicorn in Silicon Valley parlance.

Among the new partners Owlet is gaining are some fashion world luminaries like Tommy Hilfiger and the chairman of Tom Ford, Domenico De Sole, who are sure to take Owlet from Utah to the world.

Congrats to everyone who made Owlet a success!

A good moment for the right vanity press/publishing service

Publishing friends, authors, business women, entrepreneurs: what do you think of this new initiative from Worth Media?

A new pipeline to publishing for their subject-matter expert members to help build and further their careers,

an opportunity for people who traditionally have a harder time getting published or recognized,

to be released through an imprint/house for an established publisher (Simon & Schuster),

and author retains the rights.

My first thought? Vanity press. In a downmarket for publishing.

And then, well, okay. It's a good business opportunity to provide publishing services direct to an underserved information-rich community. And, then, hey maybe better than OK. For everyone involved, including the readers of these books. Read about it here.

Can a venture studio change the racial dynamic in Silicon Valley?

Have you heard of venture studios?

They're like movie studios, but instead of producing and releasing movies they create startups ready to scale. A venture studio focuses on just a few ventures and puts more funding into them than you'd see with an accelerator which places many small bets. They also recruit top executives once the existential question of "is this solution commercially viable?" can be answered with "yes".

One venture studio may be a way to solve a longtime problem in Silicon Valley: only 1% of VC goes to black- or brown-founded startups.

The sweet spot of Revitalize Venture Studio, from longtime SaaS entrepreneur Clarence Wooten, is knowing how to get a high-potential startup founded by diverse black and brown founders to product-market fit.

Often these are the very founders that lack access to early seed capital (up to $750K, far beyond most Family & Friends raises) needed to extend the life of their startup to get to product-market fit, which is a necessary stage to attract VC funding for Series A.

I just had the pleasure of meeting Clarence and learning more about his venture studio and want you to take a look at this pragmatic opportunity to support more POC in the Silicon Valley universe.

Radical, systemic change in the tech industry starts with us

You may have guessed that women in tech & digital are under represented across management/teams.

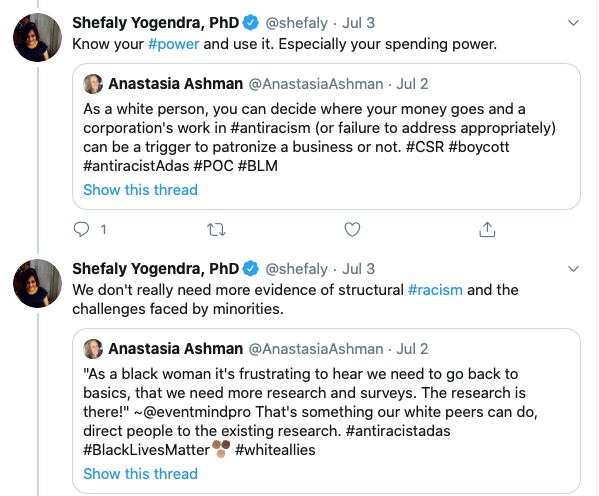

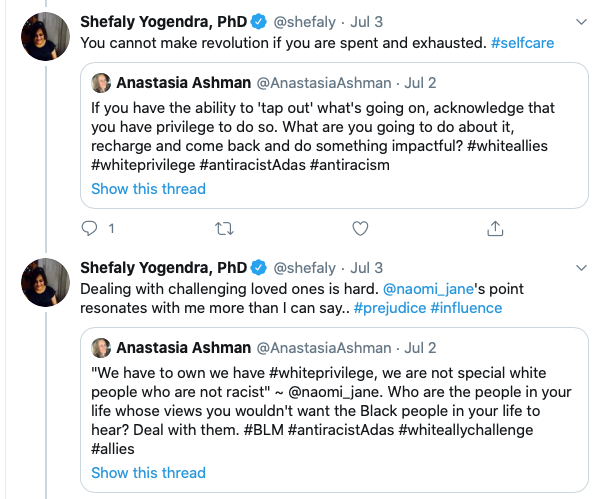

I live tweeted an antiracism panel attended by 300 people from around the global and produced by Ada's List, an intersectional group committed to changing the tech industry at scale — from culture of a company, an overt policy, to processes that sideline women.

Radical, systemic change starts with us, says Ada’s List founder Merici Vinton.

Ada’s List is the place for professional women who work in and around the internet to connect, conspire, and take a stand. The group of 700

promote, support, hire & interview women

recommend 1 qualified woman or POC to interview for each open position

make our environment positive

help juniors progress in their careers

Sound familiar? It’s their take on the Shine Theory of Aminatou Sow and Ann Friedman, says Vinton.

On White Privilege: Getting uncomfortable with our privilege, bias, and 3 actions to take is an event to keep focused on dismantling racist structures, raises funds for three Black-led organizations (@TheSisterSystem @ThisIsYSYS @azmaguk), and is part of the Ada’s List ReStructure Series. The rolling series of talks discuss and proactively work through some of the biggest issues coming out of the events happening right now.

"How are you doing?", Vinton as moderator of the panel asks the women of color, re Black Lives Matter protests.

"I spent the last 3 mos having these conversations. The process of exploring, meeting people where they are is quite healing," says one woman.

"Pissed it's taken so long for people to recognize this is a problem," answers another.

In company replies to BLM, "The voice of perpetrators & observers was amplified, centering their response rather than centering the pain,” points out Shefaly Yogendra. She digs into this in her blog "BLM in the Boardroom". "Where are your metrics?" she asks these companies that are virtue signalling. (Read Shefaly’s Twitter thread about the panel.)

Virtue signalling. Have you heard of it? Another example of virtue signaling is the number of “BlackoutTuesday” profiles vs. the number of people signing petition to see justice done in the case of Breonna Taylor, one panelist pointed out.

"This is 400 years of oppression, it's not going to be solved in a webinar," says a panelist.

Also, "Resistance is normal", it's not a sign you shouldn't continue to speak up as a white ally when appropriate....get used to that feeling.

Be aware where you can be most effective. Not all platforms are the right place, fighting trolls on Twitter may not be worth your while.

Some conversations will be more effective when done in private. But NOT saying something is no longer an option.

"Diversity and inclusion is like any other business performance metric, or at least it should be," says Ashanti Bentil-Dhue

"Don't ask POC to do your org's work for free" says Yogendra.

"Talking about race is a non-negotiable now," adds Bentil-Dhue, but some business leaders think it's optional.

"We have a problem in the corporate space that can't talk about unconscious bias, in gender & race," says Naomi Jane.

As a white person, you can decide where your money goes and a corporation's work in antiracism (or failure to address appropriately) can be a trigger to patronize a business or not.

"As a black woman it's frustrating to hear we need to go back to basics, that we need more research and surveys. The research is there!" says Bentil-Dhue.

That's something our white peers can do, direct people to the existing research.

This history of management is based in slavery & we have to address that to improve

The history of management is based in slavery, once you see it you can see what it's doing to the people you work with and what you can change to make people the best they can be, says Yogendra.

If you have the ability to 'tap out' from what's going on, acknowledge that you have privilege to do so.

What are you going to do about it, recharge and come back and do something impactful?

How does the recruitment process or governance structure of your organization perpetuate racism?

POC have to provide unpaid labor to teach white people not to be racist.

"When white people can't get your name right chances are everything you do will be reduced to a stereotype," says Shefaly Yogendra.

Getting someone's name wrong is a micro aggression. White people, make the effort to get a POC's name right (and no need to make a big deal about doing so, it's the same as your name, just a name).

What's a good way to address intersectional identities?

Find & amplify people who have those intersectionalities & pay them for their fundamentally important expertise. We have to pay them, says Naomi Jane.

Our advisor Craig Kornblau advises Google Ventures on the future of film in a streaming world

It's been wonderful for the past year and a half having Craig Kornblau advise our entertainment tech startup 10 BLOCK — and Google Ventures’ GV — on the intersection of the entertainment industry and the tech world. "The reason I decided to work with early-stage and growth companies is, having lived in big corporate America and big entertainment companies, it's really hard to find massive innovation in large companies. I think real innovation is going to come from small companies," he says in this interview about the future of film in a streaming world.

Ghost kitchens: In the news for fraud, and as a good VC investment?

I went out to dinner 2 weeks ago and ended up talking to a TV reporter for an investigative segment he was working on about the ghost kitchens of GrubHub. That particular restaurant’s owner was shocked to find his establishment being advertised on GrubHub since he does not have a listing there, and doesn’t even do delivery. So who made the food that the online delivery customer ordered? And who received the customer’s cash for it?

This brand hijacking system needs an immediate revisit.

I saw that a week earlier, a local blog reported the poor conditions at a ghost kitchen.

Read broke-ass Stuart’s reporting on ghost kitchens in San Francisco’s SOMA district.

And yet today, an industry intelligence newsletter says that "ghost kitchens are red hot" today because they let restaurants operate without brick and mortar dining locations. That’s PitchBook Data.

Meanwhile, the ghost kitchens turn out fraudulent food, defrauding restaurants and diners alike (as seen in the news stories above). This is a good investment? In the time of COVID19??

In the news & behind the scenes: it’s the flywheel

Scott Galloway takes on the streaming wars in this week’s No Mercy/No Malice newsletter.

He writes

“My colleague Sonia Marciano teaches that to achieve success, the best strategy is to find the dimension with the greatest variance — the biggest delta between best and worst. In the streaming wars, both flywheel and distribution offer the greatest variance, and monopolies dominate those categories.

“A flywheel is a disk that stores kinetic energy and then spins it out to a nearby engine. In the context of business, as the flywheel rotates it increases output or revenue without increasing input or cost. The ultimate flywheel is Amazon. Amazon Prime attracts shoppers who want a wide assortment of products with rapid fulfillment. These subscribers also enjoy the benefits of services like Amazon Prime Video, which increase the stickiness of Prime and time spent on the platform.”

Here’s Galloway on how these flywheels, or feedback loops, can work in the world of video on demand, the world of 10 Block…the mobile streaming platform I’ve been running as chief operating officer for the past two years.

“In the context of the streaming wars, SVOD adds momentum to the flywheel. Movies and entertainment evoke powerful emotions. The connective tissue of the flywheel is increasingly emotion. The NPS score (consumers’ emotional connection to a company) is negative to zero for ecommerce and internet companies, but it’s strong for SVOD companies. Loving Fleabag means you’ll buy your next toaster from Amazon, not Target or Williams-Sonoma.”

It was interesting to read Scott Galloway today talking about the winner-take-all effect of flywheels in the context of the streaming war macrocosm. As the cofounder of a mobile streaming platform, talking about the microcosm of the flywheel we built into the product fills my days. Those emotions that drive the flywheel in our patent-pending social discovery system drive viewers to share what they’re watching, what they think of it, and invite friends to view with them.

I took a peek back at some of my own shorthand sources and insights on flywheels and growth loops captured on a Trello card. (Trello is my favorite productivity tool at the moment, and for quite a while, BTW. <More on that later.)

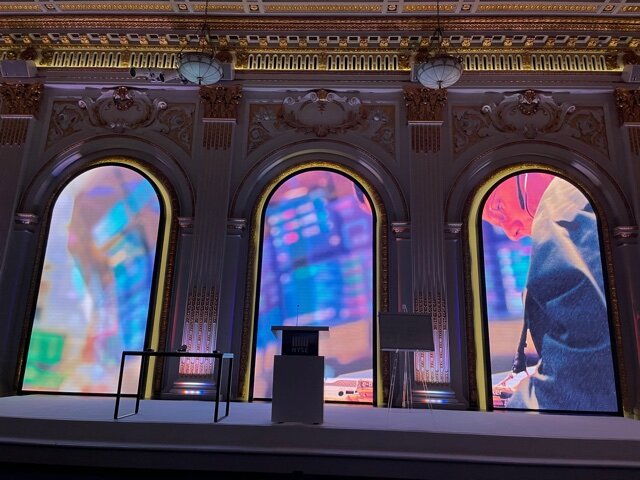

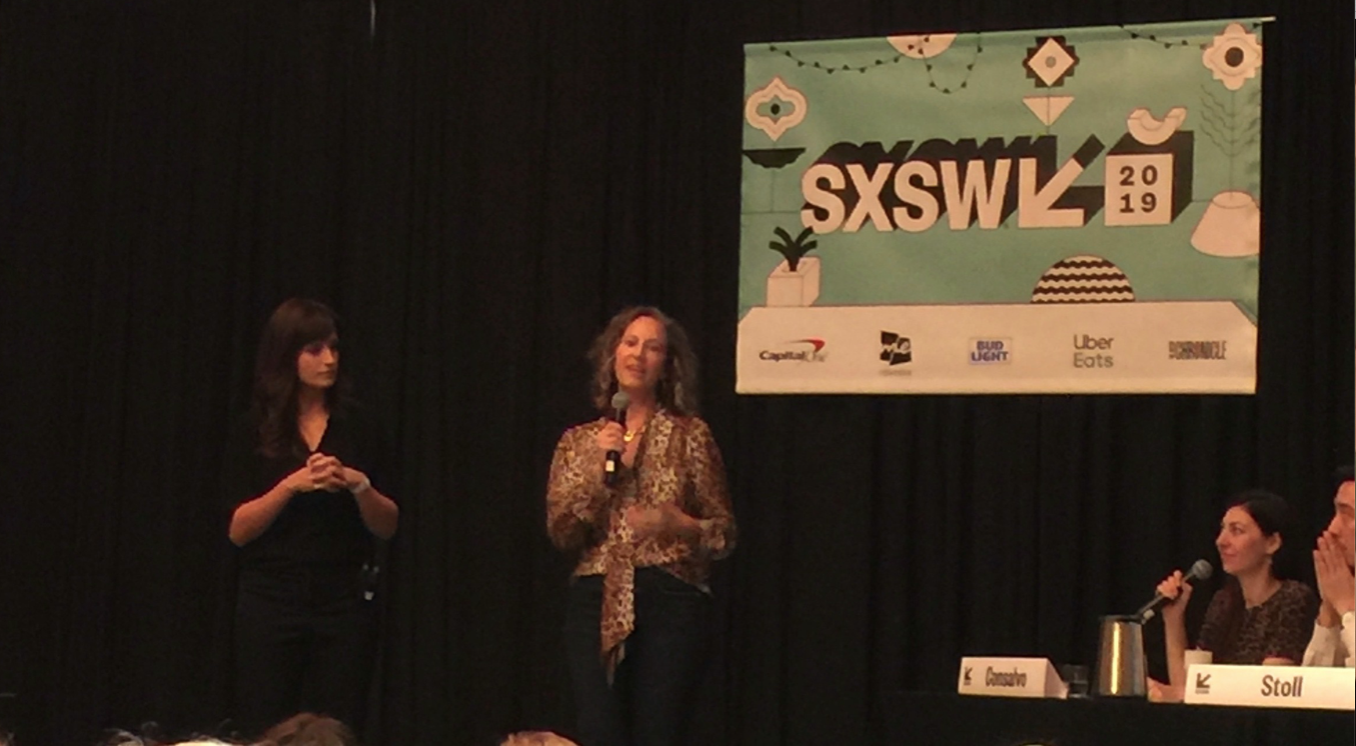

Launched onstage in SXSW 2019's top 10 product launches

TBT, '80s Meatpacking District fashion, society, film production

Remembering an arty, downtown jet-set of the late '80s....at the first fashion show of an emerging Houston designer, featuring the granddaughter of a woman who was married to Howard Hughes.

Here's what the New York Times reported about a later event by the same emerging designer.

And here’s what Cathy Horyn wrote in The Washington Post about what she called the “first show” of B. Moody (but clearly it wasn’t the first show, 👆that was, in 1987.)